Opening bell

- December 9, 2024

- 3min read

CPI Projected to Be Higher: DXY Recovery Possible Before Wednesday

To kick off the week, we have the DXY possibly making a recovery from this point to 106.400 or higher, as CPI data this Wednesday is projected to come in higher.

The U.S. Consumer Price Index (CPI) data scheduled for release on December 11, 2024, is anticipated to show a year-over-year increase to 2.7%, up from the previous 2.6% – showing a slight uptick in inflation. The month-over-month core CPI is expected to remain steady at 0.3%.

| Data Point | Previous | Forecast |

| Core CPI (m/m) | 0.3% | 0.3% |

| Core CPI (y/y) | 2.6% | 2.7% |

Overall, the DXY is bearish as it hit our 108.000 projection as part of a ABC corrective wave. However, these projections do bring about the speculation for a rate hold in the coming December 18th Fed Fund Decision, which currently sits at 16.6%.

These speculations could help DXY recover slightly before the actual data is revealed on Wednesday.

DXY Technical Analysis

The DXY recently failed to breach 108, signalling potential downside toward sub-104.000 or even the September low of 100.157. However, several technical indicators suggest a near-term bullish reversal is possible.

Several technical bullish observations to consider:

- The Bollinger Bands® with EMA-20, and Standard Deviation 1 shows that DXY is currently at a dynamic support level.

- The Daily Stochastic RSI is forming a double bottom formation, a bullish indication for a reversal.

- The MACD histogram is showing a hidden bullish divergence, which hints at a bullish continuation of DXY’s local uptrend.

Reversal Targets and Scenarios:

- DXY could reverse to approximately 106.427 – the upper Daily Bollinger Bands, or around the April Highs at 106.517.

- If the DXY can break above the April Highs, it could potentially see price continuation back towards 108 for a Double Top.

A small recovery on DXY would exert pressure on the overall markets, lowering asset prices against the dollar. We suggest pairing this analysis with smaller time frame analyses to spot the beginning of a potential reversal on DXY.

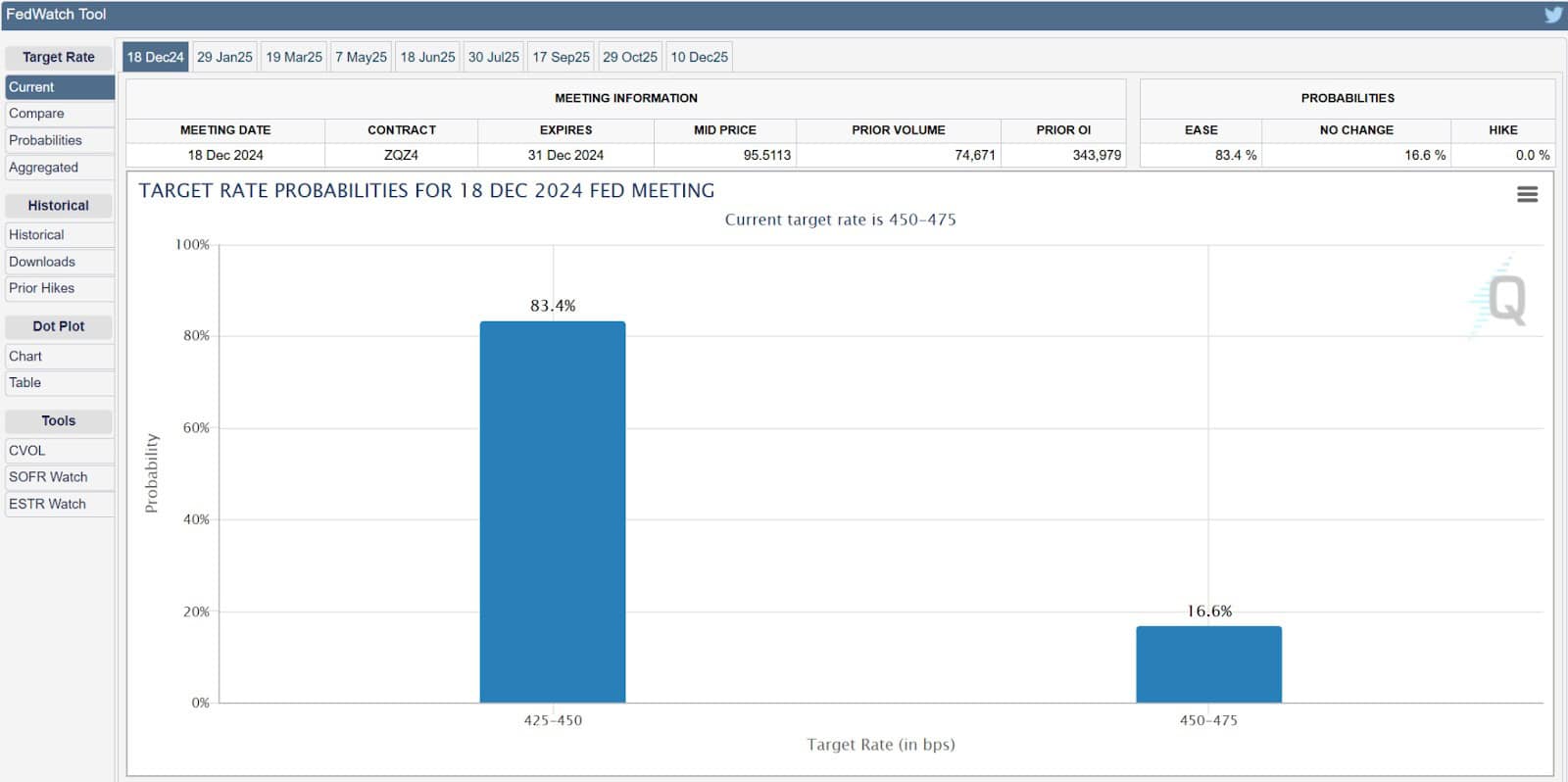

Fedwatch Tool Currently Indicates Majority Bias to Rate Cut

The CME Group’s Fedwatch Tool now shows an 83.4% probability of a rate cut in December, up from 61.58% at the start of the month. This shift reflects softer economic data, including a cooling labour market and slower wage growth, which increases the likelihood of policy easing.

This change in expectations is influenced by recent economic indicators, such as the November jobs report, which showed stronger-than-expected payroll gains of 227,000 jobs and a slight uptick in the unemployment rate to 4.2%. These data points suggest a cooling labor market, increasing the likelihood for a rate cut.

Overall, a majority probability of a rate cut will put pressure on the DXY until December 18th, the next FOMC meeting.

Closing Thoughts

While the DXY faces medium-term bearish risks, short-term factors like the anticipated CPI uptick could drive a temporary recovery.

Traders should monitor Wednesday’s data closely for confirmation of these expectations, while keeping an eye on the Fed’s December rate decision for broader market impacts.

You may also be interested in: